How can I confirm a trend using chart analysis?

How Can I Confirm a Trend Using Chart Analysis?

Introduction

Trading days often feel like a crowded market of opinions. A solid answer to “which way is price likely to move next?” comes from what the chart is actually saying, not just what you feel in your gut. This piece maps out a practical way to confirm a trend using chart analysis, with real-world flavor across forex, stocks, crypto, indices, options, and commodities. We’ll mix clear signals, a workable workflow, and a look at how DeFi and AI are reshaping the scene—all while keeping you focused on risk and reliability.

What it means to confirm a trend

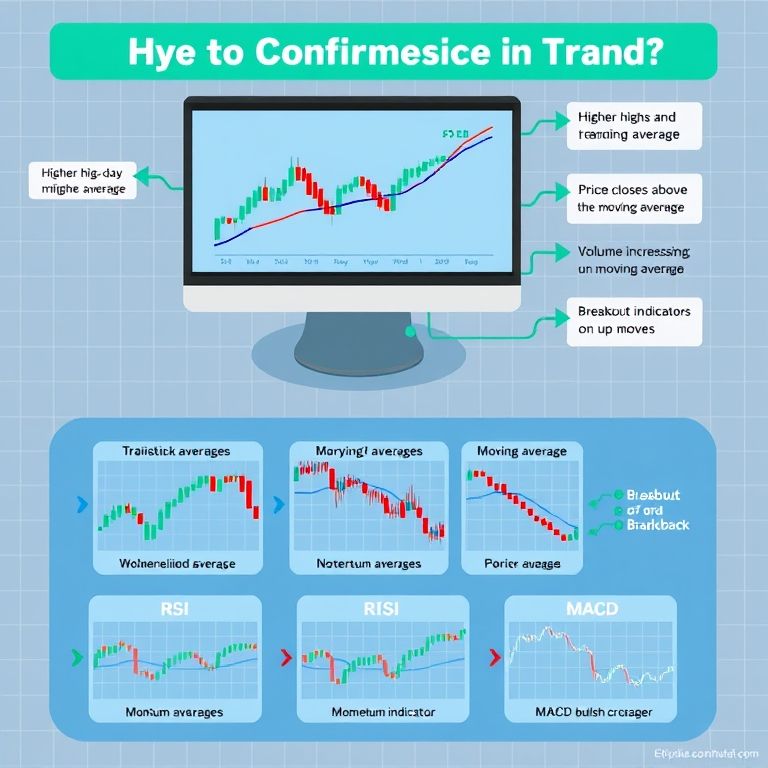

A trend isn’t just a line sloping up or down. It’s a sustained sequence of higher highs and higher lows in an uptrend, or lower highs and lower lows in a downtrend, backed by price action that keeps the pace with momentum. Confirmation means multiple elements align: price action, volume, and momentum tools all point in the same direction. Think of it like tightening a knot—one strand might loosen, but several together make the hold credible.

Core signals you can rely on

- Price structure and chart patterns: Clear higher highs and higher lows signal an uptrend; lower highs and lower lows signal a downtrend. Channels, trendlines, and consolidation breakouts (like a breakout from a flag or triangle) can confirm the direction.

- Moving averages: A common setup is price riding above a short-term moving average while a longer average stays above as well. A bullish cross (e.g., a faster MA crossing above a slower one) often accompanies new trend energy.

- Breaks with volume: When price breaks a trendline or a key level on above-average volume, you’re seeing participation behind the move—ptentially strengthening the trend.

- Momentum indicators: MACD turning positive with rising histogram or RSI holding above midline supports momentum; divergences can warn when the suite isn’t lining up.

- Price action tests: After a breakout, a pullback to test the breakout level and hold can be a healthier follow-through signal than a quick reversal.

- Context and consistency: A trend that persists across multiple timeframes (e.g., daily and 4-hour charts) tends to be more robust than a one-off move on a single frame.

A practical workflow you can apply

- Set the frame: Pick a primary timeframe for the trend, then scan a higher and a lower timeframe to verify consistency.

- Draw the lines: Plot a trendline or channel on price highs and lows. Note where prices respect or break those lines.

- Check the confluence: Look for alignment among price action, a move above/below key moving averages, and a volume spike on breaks.

- Confirm with multiple indicators: Use momentum and price-action signals together rather than relying on a single indicator.

- Manage risk: Define a stop area just beyond a support or resistance boundary and size the position to your risk tolerance.

- Confirm across assets: If a trend holds in one instrument, check related assets (e.g., a commodity plus its related equities or futures) to gauge broader momentum.

Asset class perspectives

- Forex: Trends often ride structural flows and interest rate differences; liquidity can shift intraday, so intraday patterns matter but longer-term trend confirmation benefits from volume and clean breaks.

- Stocks and indices: Corporate events can puncture trends; look for broader market participation and sector strength to validate a move.

- Crypto: Higher volatility demands stricter risk controls; confirm trends with on-chain data (where available) and sustained volume.

- Options and commodities: Use options to hedge or fine-tune exposure, but beware decay and volatility spikes that can distort purely price-based signals.

- General note: Across assets, avoid over-optimizing to a single signal; a trend often survives only when price, volume, and momentum cooperate.

Reliability tips and leverage strategies

- Reliability over bravado: Favor multi-timeframe alignment and price-action validation over flashy indicators.

- Position sizing and risk controls: Use fixed fractions or tiered sizing; cap leverage to what you can endure in adverse moves.

- Use hedges: For high-volatility assets like crypto or volatile indices, consider protective options or dynamic stop adjustments as the trend evolves.

- Paper-trade and backtest where possible: Test how your confirmation rules would have behaved historically before risking real capital.

DeFi, web3, and the road ahead

Decentralized finance adds complexity to trend confirmation. Liquidity fragmentation, oracle risk, and smart contract vulnerabilities can create misleading price signals or execution delays. Yet, the upside is compelling: on-chain data feeds, immutable trade records, and programmable strategies enable new forms of trend-following with transparent rules. Traders increasingly blend on-chain metrics with traditional chart signals to verify trends, while staying mindful of security and counterparty risk in permissionless markets.

AI-driven trading and smart contracts

Smart contracts automate rule-based responses to confirmed trends, reducing reaction time and human error. AI can help sift through vast multi-asset data, flagting confluence across timeframes and sentiment signals. But with automation, checks remain essential: protect against model drift, ensure updates reflect current market regimes, and maintain robust risk controls. The future likely includes hybrid setups where human judgment handles outsized events while machines handle consistency and speed.

Promotional slogan

See the trend clearly, trade with confidence. How can I confirm a trend using chart analysis? With the right blend of price action, momentum, and risk discipline, your chart becomes a compass in a noisy market. Trend with clarity, not with guesswork. Confident trend confirmation—your edge in forex, stocks, crypto, and beyond.